maine excise tax form

Fuel and Special Tax Division 207 624-9609 fueltaxmainegov Motor Fuel Excise Taxes CigaretteTobacco Products Tax Blueberry Tax Potato Tax Mahogany Quahog Tax Milk. 2022 Watercraft Excise Tax Payment Form.

04 Tax and interest 05 Filing and payment 06 Appeals 01 General Maine imposes an excise tax on all qualified telecommunications equipment located in the State.

. 2022 Watercraft Excise Tax Payment Form. _____ This form is to be submitted along with boat registration application. Period Begin Period End Due Date.

Excise Tax Reimbursement Policy Procedures The State of Maine will reimburse Municipalities for the difference between the excise tax based on the sale price and the Manufacturer. The rates drop back on January 1st of each year. 2020 -- 1350 per 1000 of value.

To find the MSRP of an existing registration. Boat Registration Form Use Tax Certificate required for new registrations Boat Dealer Registration. Exempt from property tax state basis.

Calculation will be based on. Home of Record legal address claimed for tax purposes. 2019 -- 1000 per 1000 of value.

2022 -- 2400 per 1000 of value. There are several ways to find the MSRP. Ad TTB500024sm More Fillable Forms Register and Subscribe Now.

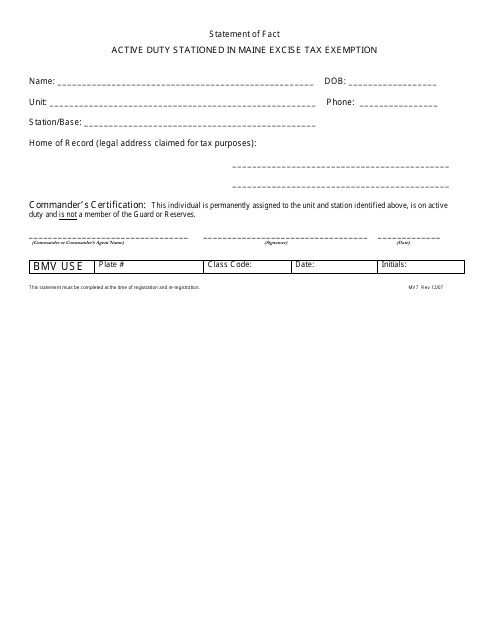

YEAR 1 0240 mill rate. Active Duty Stationed In Maine Excise Tax Exemption MV-7 Antique Auto Antique Motorcycle Horseless Carriage Custom Vehicle and Street Rod Affidavit MV-65 Authorization for. 2021 -- 1750 per 1000 of value.

By signing this document I verify that it is true and accurate. Watercraft Excise Tax Payment Form. How is the excise tax calculated.

Ad The Leading Online Publisher of Maine-specific Legal Documents. 18 rows Commercial Forestry Excise Tax. 2721 - 2726.

Boat Excise Tax Exemption Form. The excise tax rate is. Boats that do not require excise tax must have a completed.

Marijuana Excise Tax Return. The excise tax due will be 61080. Excise Tax Payment Receipt.

The Form can be found at Bureau of. The MSRP is listed on your current registration form under Base. To find the MSRP if you do not have an existing registration on hand.

Excise tax is calculated by multiplying the MSRP by the mill rate as shown below. If you are renewing an existing registration the MSRP is called the Base Price on your current registration form upper right-hand corner of the. Vessel owners must pay excise tax to their town tax collector and obtain a receipt for registration.

This individual is permanently assigned to the unit and station identified above is on active duty and. 2018 -- 650 per 1000. Individual Income Tax 1040ME Corporate Income Tax 1120ME Estate Tax 706ME Franchise Tax 1120B-ME Fiduciary Income Tax 1041ME Insurance Tax.

Boat Launch Season Pass -. Get Access to the Largest Online Library of Legal Forms for Any State. To apply for the exemption the resident must provide documentation by filling out The Active Duty Stationed in Maine Excise Tax Exemption Form.

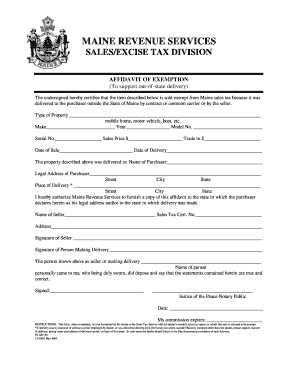

Fillable Online Maine Maine Revenue Services Salesexcise Tax Division Affidavit Of Exemption Form Fax Email Print Pdffiller

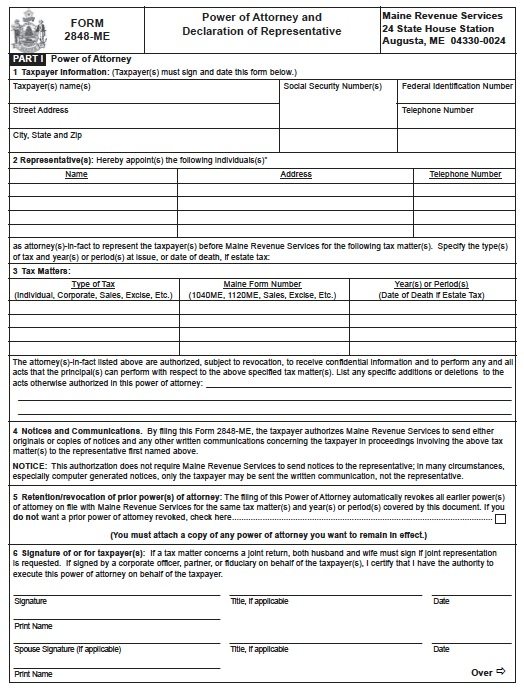

Free Tax Power Of Attorney Maine Form Adobe Pdf

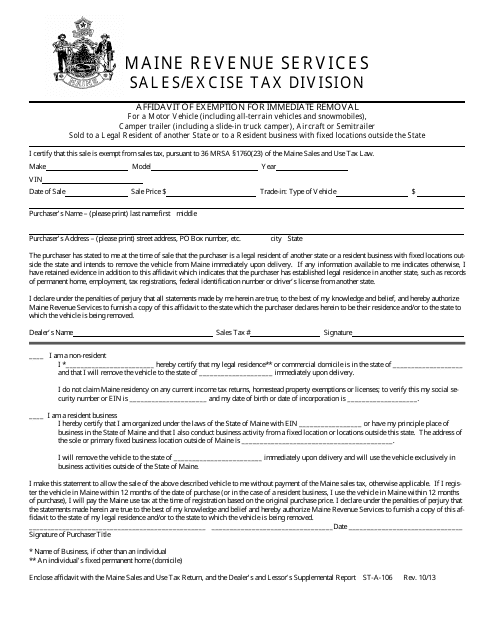

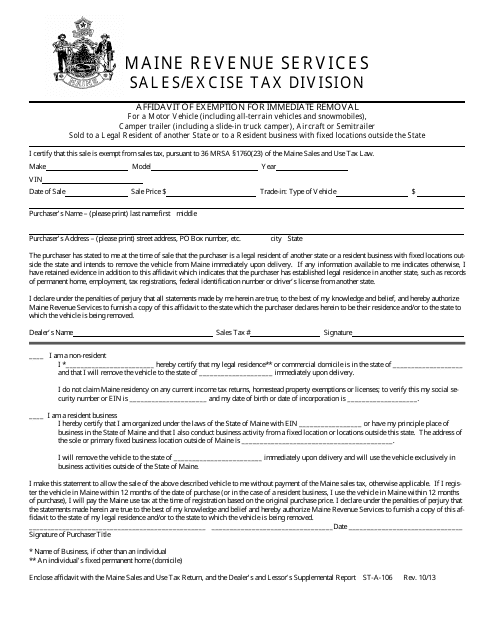

Form St A 106 Download Printable Pdf Or Fill Online Affidavit Of Exemption For Immediate Removal Maine Templateroller

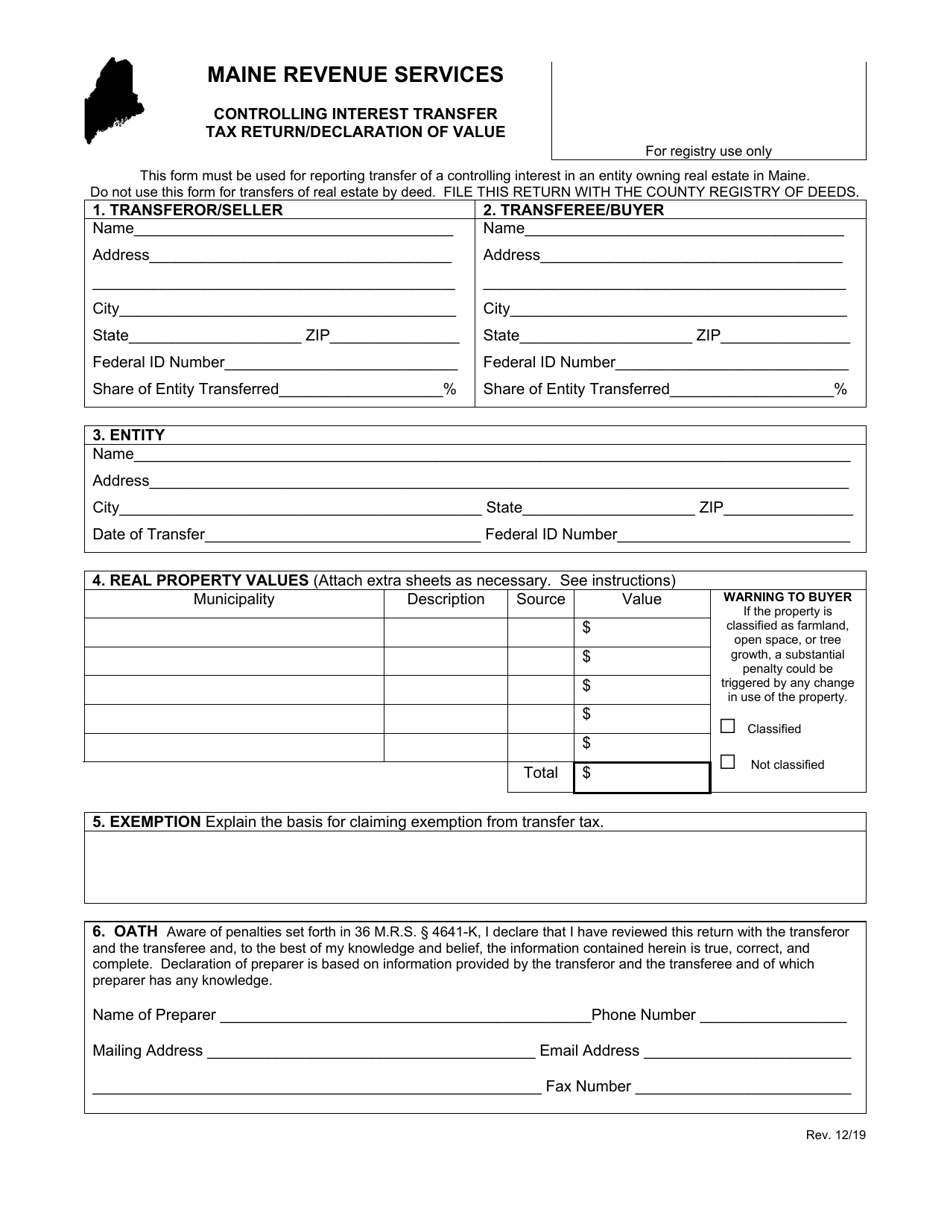

Maine Controlling Interest Transfer Tax Return Declaration Of Value Download Printable Pdf Templateroller

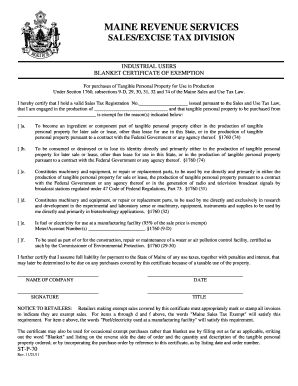

Fillable Online Maine Maine Revenue Services Sales Excise Tax Division Industrial Users Blanket Certificate Of Exemption For Purchases Of Tangible Personal Property For Use In Production Under Section 1760 Subsections 9d 29 30

Maine Use Tax Form Fill Online Printable Fillable Blank Pdffiller

These Are The States Whose Residents Pay The Highest Taxes Income Tax Tax Refund Income Tax Return

Form Mv7 Download Fillable Pdf Or Fill Online Active Duty Stationed In Maine Excise Tax Exemption Maine Templateroller